01

Transelec is the most important power transmission company in Chile

Transelec is the leading high-voltage power transmission system supplier in Chile and the most important power transmission company in the country. Transelec develops and operates power infrastructure, supplying power to 98% of Chile’s population. In addition, Transelec facilities consist of 10,049 kilometers power transmission lines. These are part of Chile’s National Power Grid, which ranges between Arica to the island of Chiloé.

10,049 Km

of circuits lines

82

substations

20,879 MVA

of processing capacity

Information as of December 31, 2023

02

Financial Information

Revenues and EBITDA*

(*) EBITDA= Revenue from ordinary activities – Abs(Sales Cost) – Abs(Administrative Expenses) + Abs(Depreciation and Amortization) + Other Earnings(Losses) + percentage of capital amortized in the financial leasing period

Cash flow for the operation (CLP bn)

Revenue by system type

Revenues by customer

Information as of June 30 2024

Annual and Quarterly Result

Financial Statements as of June 30th, 2024 will be sent to CMF from August 29th, 2024 and subsequently published on the website.

Debt

The company has obtained flexibility and several sources of financing, maintaining its Investment Grade rating at all times.

Public debt maturity profile (CLP bn)

Public debt issued by currency

Graphs as of June 30, 2024

Covenants

| Covenant | Limit | 30-06-2024 | 31-12-2023 |

|---|---|---|---|

| Capitalization Ratio* | < 0,7 | 0.65 | 0.67 |

| Minimum equity (in UF mn) | > 15 MM UF | 28.07 | 26.08 |

| Minimum equity (in CLP mn) | > B CLP 350 | 1,055 | 959 |

| Net Debt / EBITDA | < 7.0x | 4.42 | 4,21 |

(*) Capitalization Ratio= Total Debt/ (Total Debt + Minoritary Interest + Controller Equity + Goodwill Amortization)

| FNO/ Financial Expenses** | > 1.5 | 4.94 | 4,20 |

|---|

(**) FNO= Cash flows from operation activities + abs (financial expenses) + abs (income taxes)

Current Bonds

| Debt | Currency or Adjustment Unit | Interest Rate | Amount Issued (millions) |

|---|---|---|---|

| Series D Bond | UF | 4.25% | 13.5 |

| Series H Bond | UF | 4.80% | 3.0 |

| Series K Bond | UF | 4.60% | 1.6 |

| Series M Bond | UF | 4.05% | 3.4 |

| Series N Bond | UF | 3.95% | 3.0 |

| Series Q Bond | UF | 3.95% | 3.1 |

| Series V Bond | UF | 3.30% | 3.0 |

| Series X Bond | UF | 3.20% | 4.0 |

| 144a Senior Notes @2025 | USD | 4.25% | 375.0 |

| 144a Senior Notes @2029 | USD | 3.875% | 350.0 |

04

Corporate Government

-

1. Blas Tomic Errázuriz

Director

-

2. Tao He

Director

-

3. Ximena Clark Núñez

Director

-

4. Andrea Butelmann Peisajoff

Director

-

5. Alfredo Ergas Segal

President

-

6. Richard Cacchione

Director

-

7. Juan Benabarre Benaiges

Director

-

8. Mario Valcarce Durán

Director

-

9. Jordan Anderson

Director

-

Board of Directors as of

July, 2024

-

1. Eduardo Tagle Gana

VICE PRESIDENT FOR LEGAL AND TERRITORIAL AFFAIRS

-

2. Francisco Castro Crichton

Chief Financial Officer

-

3. Paola Basaure Barros

CORPORATE AFFAIRS & SUSTAINABILITY VICE-PRESIDENT

-

4. Alejandro Rehbein Oroz

VICE PRESIDENT OF INNOVATION AND TECHNOLOGY

-

5. Arturo Le Blanc Cerda

Chief Executive Officer

-

6. Claudio Aravena Vallejo

People & Organization vice-president

-

7. Olivia Heuts Goen

Business Development Vice-President

-

8. Bernardo Canales Fuenzalida

Engineering & Project Development Vice-President

-

9. Claudia Carrasco Arancibia

VICE PRESIDENT OF REGULATION AND REVENUE

-

10. Jorge Vargas Romero

Chief Operating Officer

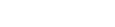

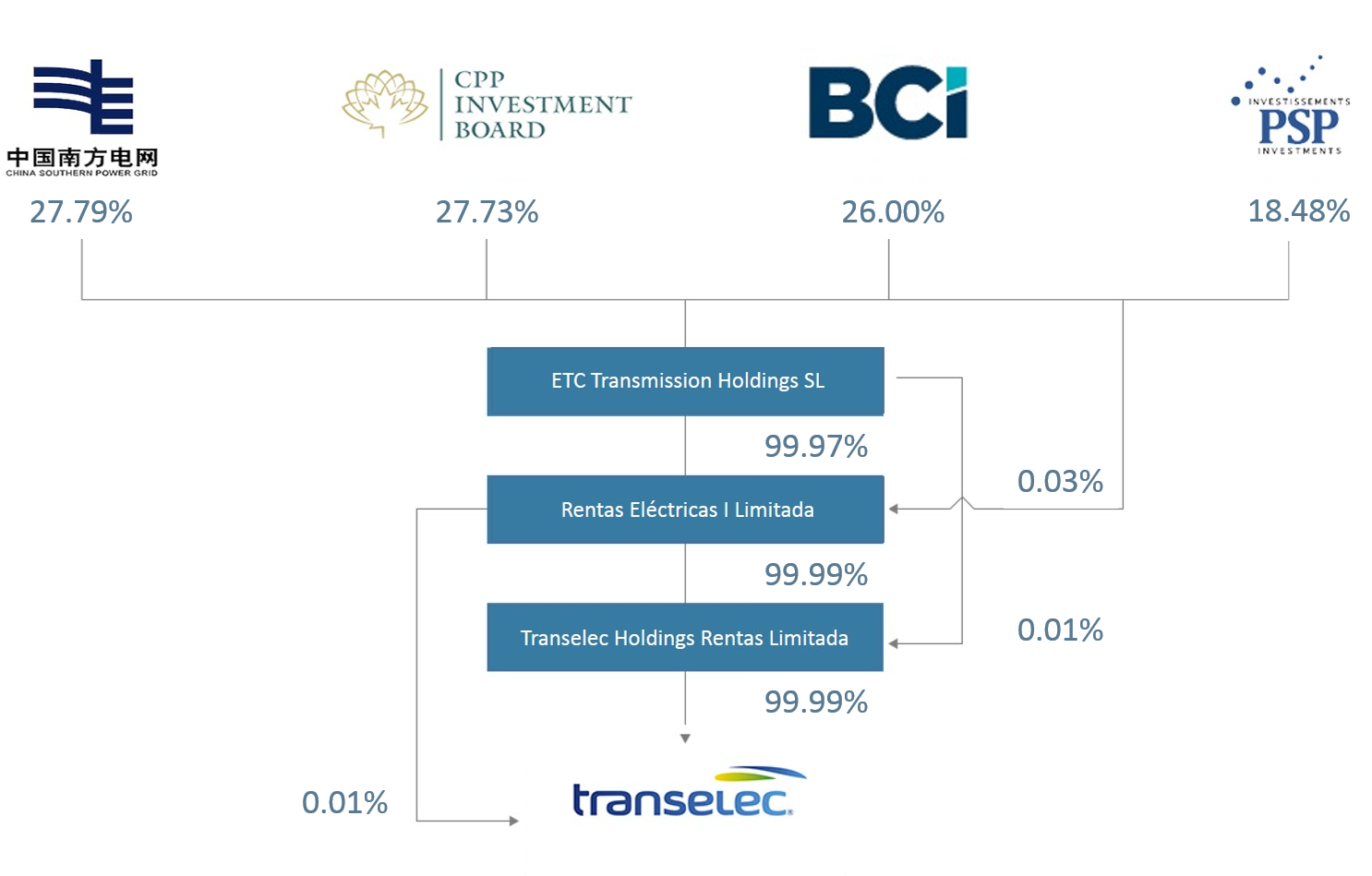

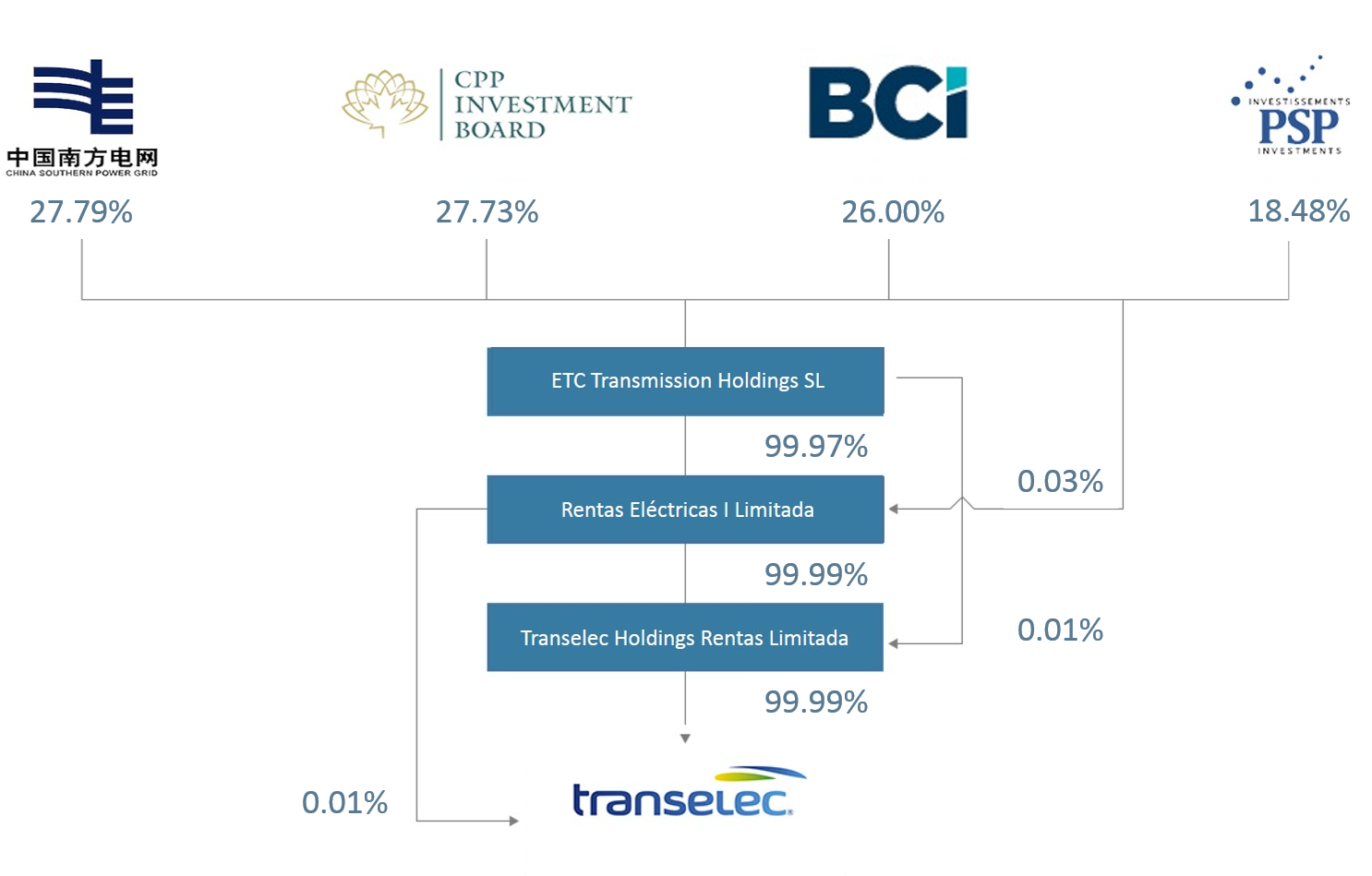

In March 2018, Brookfield Asset Management (BAM) sells its stake in Transelec to the chinese company Southern Power Grid International (CSG). The Transelec property is now composed of Canadian Pension Plan Investment Board (CPP), British Columbia Investment Management Corp. (bcIMC), Public Sector Pension Investment Board (PSP) and China Southern Power Grid International (CSG), who place their great financial strength and operational experience at the service of the country’s growth needs.

The profit sharing policy states that during a specific fiscal year, the Board of Directors aims to distribute 100% of the net profits reported as dividends, considering the company’s financial situation, commitments made by Transelec when the company issued bonds on the national and international markets, and considering the impacts of implementing IFRS.

No dividend may be declared if it would prevent the company from meeting its financial commitments.

With respect to a specific fiscal year, the Board of Directors may consider it appropriate to declare temporary dividends that could be distributed depending on conditions at the time. Overall temporary dividends shall not exceed 75% of the company’s profit that can be distributed for the current fiscal year according to the latest forecast available.

Our shareholders have created several committees in order to be kept informed regarding important issues and thus support the company at all levels.

Audit Committee

Creation of an Audit Committee was approved in April 2007. This committee is different from the committee indicated in the Corporations Law, whose duties include, among others, reviewing the company’s audit reports, balance sheets and other financial statements, and internal systems. The Transelec Audit Committee is comprised of four directors, who are appointed by the Board of Directors and serve for a terms two years, after which they may be re-elected. The Committee will elect a chairman from among its members and a secretary, who may be one of its members or the secretary of the Board of Directors.

Investor Advisory Committee

The Investor Advisory Committee is comprised of directors and senior executives. Its mission is to improve information submitted to the Board of Directors regarding the company’s different projects oportunities and thus facilitate decision making by the Board of Directors.

Corporate Reputation and Regulatory Committee

The Corporate Reputation and Regulatory Committee is comprised of company directors and executives. It meets twice per semester to review the Corporate Reputation and Regulatory Strategy, which will be executed in keeping with the main legal and regulatory amendments made in the power and environmental sectors, and to lead tariff setting processes for the national and zone power transmission systems.

Finance Commitee

The Finance Committee is made up of company directors and executives. It meets periodically to review the company’s financial strategy and to provide consultancy and approve different proposals that are important for the financial activities being executed by Transelec.

Human Resources Committee

The Human Resources Committee is comprised of company directors and executives. It meets at least once per year to review issues related to the people who make up the Transelec team. The issues reviewed include the revision of financial KPIs, which are the basis of the current variable bonus pyramidal structure at the company, as well as other issues related to the development of people, training, etc.

Operations Committee

The purpose of this Committee is to offer the Transelec Administration the opportunity to discuss issues of operations in detail with members of the Board. It is responsible for the supervision of health and safety programs stablished from Transelec’s recommendations on KPIs for health, safety and operation.

Corporate Governance Committee

The Corporate Governance Committee is comprised of Company directors and executives who meet twice per year to propose and nominate members of the Board of Directors and to evaluate their management. In addition, their mandate includes examination and evaluation of Transelec corporate governance guidelines and making recommendations regarding these to the Board of Directors.

Other Committees

Coordination Committees: these involve the different Transelec vice-presidencies and are held regularly in order to coordinate the most important issues for the company:

- Executive Committee

- Business Committee

- Projects Committee

- Operational Excellence and Results Committee

- Regulatory Agenda

- Innovation Committee

Integral management system committee: This committee has as it mission discuss about safety and ocupational security, envirinmental matters, and quality issues.

-

1. Blas Tomic Errázuriz

Director

-

2. Tao He

Director

-

3. Ximena Clark Núñez

Director

-

4. Andrea Butelmann Peisajoff

Director

-

5. Alfredo Ergas Segal

President

-

6. Richard Cacchione

Director

-

7. Juan Benabarre Benaiges

Director

-

8. Mario Valcarce Durán

Director

-

9. Jordan Anderson

Director

-

Board of Directors as of

July, 2024

-

1. Eduardo Tagle Gana

VICE PRESIDENT FOR LEGAL AND TERRITORIAL AFFAIRS

-

2. Francisco Castro Crichton

Chief Financial Officer

-

3. Paola Basaure Barros

CORPORATE AFFAIRS & SUSTAINABILITY VICE-PRESIDENT

-

4. Alejandro Rehbein Oroz

VICE PRESIDENT OF INNOVATION AND TECHNOLOGY

-

5. Arturo Le Blanc Cerda

Chief Executive Officer

-

6. Claudio Aravena Vallejo

People & Organization vice-president

-

7. Olivia Heuts Goen

Business Development Vice-President

-

8. Bernardo Canales Fuenzalida

Engineering & Project Development Vice-President

-

9. Claudia Carrasco Arancibia

VICE PRESIDENT OF REGULATION AND REVENUE

-

10. Jorge Vargas Romero

Chief Operating Officer

In March 2018, Brookfield Asset Management (BAM) sells its stake in Transelec to the chinese company Southern Power Grid International (CSG). The Transelec property is now composed of Canadian Pension Plan Investment Board (CPP), British Columbia Investment Management Corp. (bcIMC), Public Sector Pension Investment Board (PSP) and China Southern Power Grid International (CSG), who place their great financial strength and operational experience at the service of the country’s growth needs.

The profit sharing policy states that during a specific fiscal year, the Board of Directors aims to distribute 100% of the net profits reported as dividends, considering the company’s financial situation, commitments made by Transelec when the company issued bonds on the national and international markets, and considering the impacts of implementing IFRS.

No dividend may be declared if it would prevent the company from meeting its financial commitments.

With respect to a specific fiscal year, the Board of Directors may consider it appropriate to declare temporary dividends that could be distributed depending on conditions at the time. Overall temporary dividends shall not exceed 75% of the company’s profit that can be distributed for the current fiscal year according to the latest forecast available.

Our shareholders have created several committees in order to be kept informed regarding important issues and thus support the company at all levels.

Audit Committee

Creation of an Audit Committee was approved in April 2007. This committee is different from the committee indicated in the Corporations Law, whose duties include, among others, reviewing the company’s audit reports, balance sheets and other financial statements, and internal systems. The Transelec Audit Committee is comprised of four directors, who are appointed by the Board of Directors and serve for a terms two years, after which they may be re-elected. The Committee will elect a chairman from among its members and a secretary, who may be one of its members or the secretary of the Board of Directors.

Investor Advisory Committee

The Investor Advisory Committee is comprised of directors and senior executives. Its mission is to improve information submitted to the Board of Directors regarding the company’s different projects oportunities and thus facilitate decision making by the Board of Directors.

Corporate Reputation and Regulatory Committee

The Corporate Reputation and Regulatory Committee is comprised of company directors and executives. It meets twice per semester to review the Corporate Reputation and Regulatory Strategy, which will be executed in keeping with the main legal and regulatory amendments made in the power and environmental sectors, and to lead tariff setting processes for the national and zone power transmission systems.

Finance Commitee

The Finance Committee is made up of company directors and executives. It meets periodically to review the company’s financial strategy and to provide consultancy and approve different proposals that are important for the financial activities being executed by Transelec.

Human Resources Committee

The Human Resources Committee is comprised of company directors and executives. It meets at least once per year to review issues related to the people who make up the Transelec team. The issues reviewed include the revision of financial KPIs, which are the basis of the current variable bonus pyramidal structure at the company, as well as other issues related to the development of people, training, etc.

Operations Committee

The purpose of this Committee is to offer the Transelec Administration the opportunity to discuss issues of operations in detail with members of the Board. It is responsible for the supervision of health and safety programs stablished from Transelec’s recommendations on KPIs for health, safety and operation.

Corporate Governance Committee

The Corporate Governance Committee is comprised of Company directors and executives who meet twice per year to propose and nominate members of the Board of Directors and to evaluate their management. In addition, their mandate includes examination and evaluation of Transelec corporate governance guidelines and making recommendations regarding these to the Board of Directors.

Other Committees

Coordination Committees: these involve the different Transelec vice-presidencies and are held regularly in order to coordinate the most important issues for the company:

- Executive Committee

- Business Committee

- Projects Committee

- Operational Excellence and Results Committee

- Regulatory Agenda

- Innovation Committee

Integral management system committee: This committee has as it mission discuss about safety and ocupational security, envirinmental matters, and quality issues.